Introduction

In the realm of technical analysis and stock trading, indicators play a crucial role in decision-making. One such indicator that has garnered attention is the Widner Mobility Oscillator MetaStock platform. This article will explore the intricacies of the Widner Mobility Oscillator, how it functions, and how traders can utilize it to enhance their trading strategies. By the end, you will have a thorough understanding of this powerful tool and be better equipped to navigate the financial markets.

Key Takeaways:

- The Widner Mobility Oscillator is an essential tool for assessing market momentum.

- Understanding how to integrate this oscillator into trading strategies can enhance decision-making.

- Knowledge of the oscillator’s signals can lead to more effective buy and sell decisions.

- The use of MetaStock can facilitate smoother and more informed trading experiences.

What is the Widner Mobility Oscillator?

The Widner Mobility Oscillator is a momentum-based indicator designed to gauge the strength of a security’s price movement. It oscillates around a neutral level, typically zero, and provides insights into whether a security is in an uptrend or downtrend.

Historical Context and Development

The oscillator was developed as part of a broader trend toward utilizing complex algorithms in trading. It is often utilized alongside other indicators to confirm signals, making it a valuable addition to any trader’s toolkit. The oscillation is calculated based on price data and can be customized to suit different trading styles, from day trading to long-term investing.

The Calculation Behind the Oscillator

At its core, the Widner Mobility Oscillator calculates the difference between two moving averages of a security’s price. This difference helps traders identify momentum changes. The formula can be expressed as:

Widner Mobility Oscillator=MAshort−MAlong\text{Widner Mobility Oscillator} = MA_{\text{short}} – MA_{\text{long}}

Where MAshortMA_{\text{short}} represents a shorter moving average and MAlongMA_{\text{long}} a longer one. Adjusting these periods can tailor the oscillator to specific trading strategies.

Setting Up the Widner Mobility Oscillator MetaStock

MetaStock is a powerful tool that allows traders to customize their trading experience. To set up the Widner Mobility Oscillator in MetaStock, follow these steps:

- Open MetaStock: Launch the software and select the chart you wish to analyze.

- Insert Indicator: Navigate to the indicators section and search for the Widner Mobility Oscillator.

- Configure Parameters: Adjust the settings for the short and long moving averages to align with your trading strategy.

- Apply to Chart: Once configured, apply the oscillator to your selected chart.

Understanding the Interface

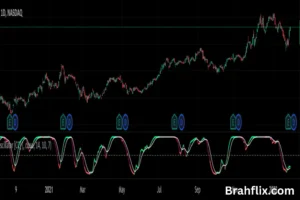

Once you have integrated the oscillator into your MetaStock charts, you will see a line oscillating above and below the zero line. These movements provide vital signals about market momentum. For instance, when the oscillator crosses above zero, it indicates a potential buying opportunity, while a cross below zero might suggest a selling opportunity.

Interpreting the Signals from the Widner Mobility Oscillator

Understanding how to interpret the signals generated by the Widner Mobility Oscillator is crucial for making informed trading decisions.

Key Signals to Watch For

- Zero Crossovers: As mentioned earlier, when the oscillator crosses above zero, it suggests upward momentum, while a crossover below zero indicates a potential decline.

- Divergences: When the price moves in one direction while the oscillator moves in the opposite direction, it signals a potential reversal. For example, if prices are reaching new highs while the oscillator is making lower highs, this divergence may indicate weakening momentum.

- Overbought and Oversold Conditions: Like other oscillators, the Widner Mobility Oscillator can indicate overbought or oversold conditions, which can help traders identify potential reversal points.

Practical Examples

- Bullish Signal: Suppose a stock’s price is trending upward and the oscillator moves above zero, signaling a strong bullish trend. This could prompt a trader to consider entering a long position.

- Bearish Divergence: If a stock’s price reaches new highs, but the oscillator fails to do so, it could suggest that the bullish momentum is weakening. A trader might decide to sell or short the stock in this scenario.

Enhancing Trading Strategies with the Widner Mobility Oscillator

Incorporating the Widner Mobility Oscillator into your trading strategy can yield significant advantages. Here’s how to effectively enhance your trading:

Combine with Other Indicators

Utilizing the Widner Mobility Oscillator in conjunction with other technical indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), can provide a more holistic view of market conditions.

Time Frame Considerations

The effectiveness of the Widner Mobility Oscillator can vary based on the time frame used. Day traders might prefer shorter moving averages, while swing traders may opt for longer periods to capture larger market movements.

Risk Management Techniques

While the oscillator provides valuable signals, it is essential to incorporate risk management strategies. This could include setting stop-loss orders based on recent price movements or limiting the size of trades to mitigate potential losses.

Advantages of Using the Widner Mobility Oscillator

The Widner Mobility Oscillator offers several advantages for traders, enhancing their market analysis and decision-making processes:

Enhanced Market Analysis

By measuring momentum, the oscillator allows traders to assess market strength more accurately. This can lead to better timing of entries and exits in trades.

Customizable Settings

Traders can tailor the oscillator’s parameters to fit their trading style, making it a versatile tool for both short-term and long-term strategies.

Improved Signal Accuracy

When used with other indicators, the Widner Mobility Oscillator can help confirm buy and sell signals, reducing the risk of false signals.

Challenges and Limitations of the Widner Mobility Oscillator

While the Widner Mobility Oscillator is a powerful tool, it is not without its challenges and limitations:

Lagging Nature

Like most indicators, the Widner Mobility Oscillator can be lagging. It may provide signals after a price movement has already occurred, leading to missed opportunities.

False Signals

In volatile markets, the oscillator may produce false signals that could result in unprofitable trades. Traders should remain cautious and consider market context before acting on signals.

Over-Reliance on Indicators

Relying solely on the Widner Mobility Oscillator or any other indicator can be detrimental. Successful trading requires a comprehensive analysis that considers fundamental factors as well.

Integrating the Widner Mobility Oscillator into Your Trading Routine

To effectively integrate the Widner Mobility Oscillator into your trading routine, consider the following steps:

Daily Review

Set aside time each day to review the oscillator’s signals alongside other indicators and market news. This will help you make informed decisions based on the most current data.

Practice with Demo Accounts

Before applying the oscillator in live trades, practice using it in a demo account. This allows you to familiarize yourself with its signals without risking real money.

Continuous Learning

The financial markets are constantly evolving, and so are trading strategies. Stay informed about market trends, new indicators, and best practices to enhance your trading performance.

Frequently Asked Questions (FAQs)

1. What is the Widner Mobility Oscillator used for?

The Widner Mobility Oscillator is used to measure momentum in stock prices, helping traders identify potential buying and selling opportunities.

2. How do I set up the Widner Mobility Oscillator in MetaStock?

To set it up, open MetaStock, navigate to the indicators section, find the Widner Mobility Oscillator, configure its parameters, and apply it to your chart.

3. Can the Widner Mobility Oscillator provide false signals?

Yes, like most indicators, it can generate false signals, particularly in volatile market conditions. It’s best used in conjunction with other indicators for confirmation.

4. Is the Widner Mobility Oscillator suitable for all types of traders?

The Widner Mobility Oscillator can be beneficial for various trading styles, including day trading and swing trading, but it should be tailored to fit individual strategies.

5. How can I improve my trading performance using the Widner Mobility Oscillator?

To improve performance, consider combining the oscillator with other indicators, implementing risk management strategies, and continuously educating yourself on market trends.

Conclusion

The Widner Mobility Oscillator in MetaStock is a valuable tool for traders seeking to enhance their market analysis and decision-making capabilities. By understanding its signals, integrating it with other indicators, and practicing good risk management, you can leverage this oscillator to improve your trading results. As you explore its functionalities, remember that successful trading involves a combination of technical analysis, fundamental knowledge, and continuous learning.

What are your thoughts on the Widner Mobility Oscillator? Have you used it in your trading strategies? If you’re interested in further enhancing your trading knowledge, check out our other blogs for more insights and strategies!