Introduction

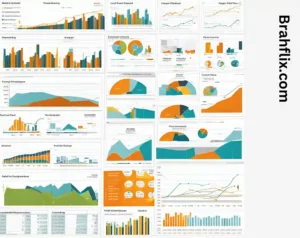

In the world of business, planning for the future is as essential as managing day-to-day operations. Financial projections serve as a roadmap for achieving long-term goals, guiding companies in making informed decisions. One of the most effective tools in this planning process is the Aba Business Financial Projection Template. This template provides a structured approach to estimating your business’s future financial performance, helping you make data-driven decisions.

In this comprehensive guide, we’ll explore how to effectively use the Aba Business Financial Projection Template to predict revenue, manage expenses, and ultimately drive profitability. By the end of this article, you’ll understand the importance of financial projections and how this template can become a cornerstone of your business strategy.

Key Takeaways:

- Financial projections are crucial for business planning and securing investments.

- The Aba Business Financial Projection Template offers a user-friendly way to forecast financial outcomes.

- Understanding revenue streams, cost management, and cash flow is vital for accurate projections.

- Regularly updating your projections ensures alignment with changing market conditions.

1. Understanding Financial Projections

Financial projections are estimates of a business’s future financial performance. They include income statements, balance sheets, and cash flow statements. These projections are typically based on historical data, market trends, and assumptions about future conditions. For businesses, especially startups, these projections are not just a tool for internal planning but are also crucial when seeking investment or loans.

Why Financial Projections Matter

Financial projections are vital for several reasons:

- Strategic Planning: They help in setting financial goals and assessing the feasibility of business plans.

- Investor Relations: Investors and lenders often require detailed financial projections to evaluate the potential return on investment.

- Risk Management: Projections allow businesses to anticipate financial shortfalls and plan accordingly.

Important Tip: Regularly revisiting and updating your financial projections can help you stay aligned with your business goals and adjust to market changes.

2. Introduction to the Aba Business Financial Projection Template

The Aba Business Financial Projection Template is a powerful tool designed to simplify the process of financial forecasting. This template is particularly useful for small to medium-sized businesses that may not have the resources to hire a financial analyst. The template typically includes sections for forecasting revenue, expenses, cash flow, and profit margins.

Key Features of the Aba Business Financial Projection Template

- User-Friendly Interface: The template is designed to be easy to use, even for those without a strong financial background.

- Comprehensive Coverage: It covers all essential financial metrics, including sales projections, operating expenses, and cash flow analysis.

- Customizable: The template can be tailored to suit the specific needs of different businesses.

Recommendation: Customize the template according to your industry and business size to ensure accurate projections.

3. Setting Up Your Aba Business Financial Projection Template

Before you start using the template, it’s essential to gather all necessary data. This includes your business’s historical financial data, current market trends, and any assumptions you’re making about future performance.

Step-by-Step Guide

- Input Historical Data: Begin by entering your business’s past financial performance into the template. This data serves as the foundation for your projections.

- Forecast Revenue: Use historical sales data and market analysis to estimate future revenue. Consider factors like seasonality, market conditions, and competition.

- Estimate Costs: Forecast your fixed and variable costs, including operating expenses, salaries, and cost of goods sold (COGS).

- Project Cash Flow: Calculate your cash inflows and outflows to ensure your business remains solvent.

- Review and Adjust: Regularly review your projections and adjust them based on actual performance and market changes.

4. Forecasting Revenue with the Aba Business Financial Projection Template

Accurate revenue forecasting is crucial for any business. The Aba Business Financial Projection Template simplifies this process by providing a structured approach to estimating future sales.

Techniques for Revenue Forecasting

- Historical Analysis: Review past sales data to identify trends and patterns.

- Market Research: Analyze your industry’s market trends and growth potential.

- Customer Segmentation: Segment your customer base to understand different revenue streams.

Statistics: According to a study by the Small Business Administration, businesses with accurate revenue projections are 30% more likely to achieve their financial goals.

5. Managing Expenses Using the Aba Business Financial Projection Template

Controlling costs is essential for maintaining profitability. The Aba Business Financial Projection Template helps you categorize and monitor your expenses, making it easier to identify areas where you can cut costs.

Types of Expenses

- Fixed Costs: Expenses that remain constant, such as rent and salaries.

- Variable Costs: Costs that fluctuate with production levels, like raw materials.

- Unexpected Expenses: Budget for unexpected costs like equipment repairs or emergency expenses.

Tip: Regularly reviewing your expense projections can help you identify opportunities for cost savings.

6. Cash Flow Management with the Aba Business Financial Projection Template

Cash flow management is critical to ensuring that your business can meet its financial obligations. The Aba Business Financial Projection Template includes tools for forecasting your cash flow, helping you avoid cash shortages.

Key Components of Cash Flow

- Operating Cash Flow: Cash generated from regular business operations.

- Investing Cash Flow: Cash used for investments in assets or securities.

- Financing Cash Flow: Cash from or used in financing activities, like loans or equity financing.

Table: Cash Flow Forecast for the Next 12 Months

| Month | Operating Cash Flow | Investing Cash Flow | Financing Cash Flow | Net Cash Flow |

|---|---|---|---|---|

| Jan | $10,000 | -$2,000 | $1,000 | $9,000 |

| Feb | $12,000 | -$1,500 | $500 | $11,000 |

| … | … | … | … | … |

7. Using the Aba Business Financial Projection Template for Profit Margins

Profit margins are a key indicator of your business’s financial health. The Aba Business Financial Projection Template allows you to project your gross and net profit margins, giving you insights into your business’s profitability.

Calculating Profit Margins

- Gross Profit Margin: (Revenue – COGS) / Revenue

- Net Profit Margin: (Net Income / Revenue) x 100

Important Statistic: Companies that regularly monitor their profit margins are 20% more likely to increase profitability over time.

8. Updating and Reviewing Your Financial Projections

Financial projections are not a one-time task. They should be regularly updated to reflect actual performance and changing market conditions. The Aba Business Financial Projection Template makes it easy to revise your projections as needed.

Best Practices for Updating Projections

- Monthly Reviews: Set aside time each month to compare your actual performance against your projections.

- Scenario Analysis: Use the template to run different financial scenarios, such as best-case and worst-case situations.

- Incorporate Feedback: If you receive feedback from investors or financial advisors, incorporate it into your projections.

Quote: “A projection is only as good as the assumptions on which it is based. Regular updates ensure those assumptions remain valid.”

9. Frequently Asked Questions

Why is it important to use a financial projection template?

Using a financial projection template like the Aba Business Financial Projection Template helps you organize your financial data, make accurate predictions, and make informed business decisions.

How often should I update my financial projections?

It’s recommended to update your financial projections at least once a month or whenever significant changes occur in your business or the market.

Can the Aba Business Financial Projection Template be customized for different industries?

Yes, the template is highly customizable, allowing you to tailor it to the specific needs of your industry and business model.

What if my actual financial performance differs significantly from my projections?

If your actual performance deviates from your projections, review the assumptions you made and adjust your projections accordingly. Regular updates can help mitigate such discrepancies.

Conclusion

The Aba Business Financial Projection Template is an invaluable tool for any business looking to forecast its financial future with confidence. By understanding and utilizing this template, you can make informed decisions that drive growth, profitability, and long-term success. Remember, regularly updating your financial projections ensures they remain relevant and aligned with your business goals.

Questions for Readers:

- How do you currently manage your financial projections?

- What challenges have you faced in forecasting your business’s financial future?

Call to Action: Explore our other blogs for more tips and tools on effective business management and financial planning.